Fitch Ratings projects $50 billion monthly gain as higher levies hit global trade

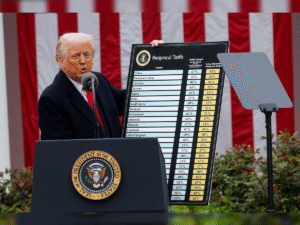

New Delhi, August 8, 2025 – The US effective tariff rate has climbed to 17% following President Donald Trump’s latest policy moves, according to Fitch Ratings. The revised rate, up from earlier levels, is expected to generate approximately $50 billion in monthly customs revenue for the American government. This increase follows a series of reciprocal and targeted tariff announcements since April, which have reshaped trade flows and triggered strong reactions from partner nations.

The average US tariff rate in 2024 was 3.3% across all products, with farm goods facing around 5% and non-agricultural goods 3%. The latest jump has pushed many categories to historically high levels. For agricultural products, duties are now at 17.6%, while non-agricultural imports carry a 13% rate. Tariffs on goods from India and Brazil will face an average rate of 16.2% and 15.7% respectively, placing them among the hardest-hit exporters.

According to WTO data, the nominal impact varies significantly by product category. For instance, certain peanut varieties entering the US attract a 54.6% duty under the MFN (Most Favoured Nation) rate, which will increase to nearly 105% after reciprocal tariffs for India and Brazil. Similarly, peanut butter faces a 44% US customs duty, and various footwear types will see tariffs of 37.5%. These hikes are part of a wider protectionist trade policy aimed at reducing the US trade deficit but have raised fears of retaliatory measures from affected nations.

China and South Africa are also among the worst affected, with effective tariff rates in the 30% range. Indonesia, Malaysia, and Mexico are facing rates between 5.5% and 8%. While the average rate masks extremes, many product categories will now face prohibitive levies that could erode price competitiveness and disrupt supply chains. This environment, experts warn, may particularly harm small businesses that have limited bargaining power with overseas buyers.

Fitch Ratings noted that the timing of these measures is significant, as the higher revenue stream from customs duties will help offset other fiscal pressures on the US economy. However, trade analysts caution that in the long run, such policies could dampen economic growth by slowing global trade volumes. Industries dependent on imported components may face cost pressures that will ultimately be passed on to consumers.

The new tariffs are part of a broader strategic shift in US trade policy under Trump, which emphasizes leveraging tariffs as a negotiation tool. While the short-term fiscal benefits are clear, economists remain divided on whether the policy will deliver sustainable advantages or deepen global trade conflicts.

Source