Bill Gates Issues Stark Warning on AI: ‘Tons of Investments Will B

News THE ECONOMIC TIMES, livelaw.in, LAW, LAWYERS NEAR ME, LAWYERS NEAR BY ME, LIVE LAW, THE TIMES OF INDIA, HINDUSTAN TIMES, the indian express, LIVE LAW .INMicrosoft co-founder cautions investors that while AI is transformative, many current investments could fail as part of a bubble-like surge

Redmond, Washington, United States | Saturday, November 1, 2025

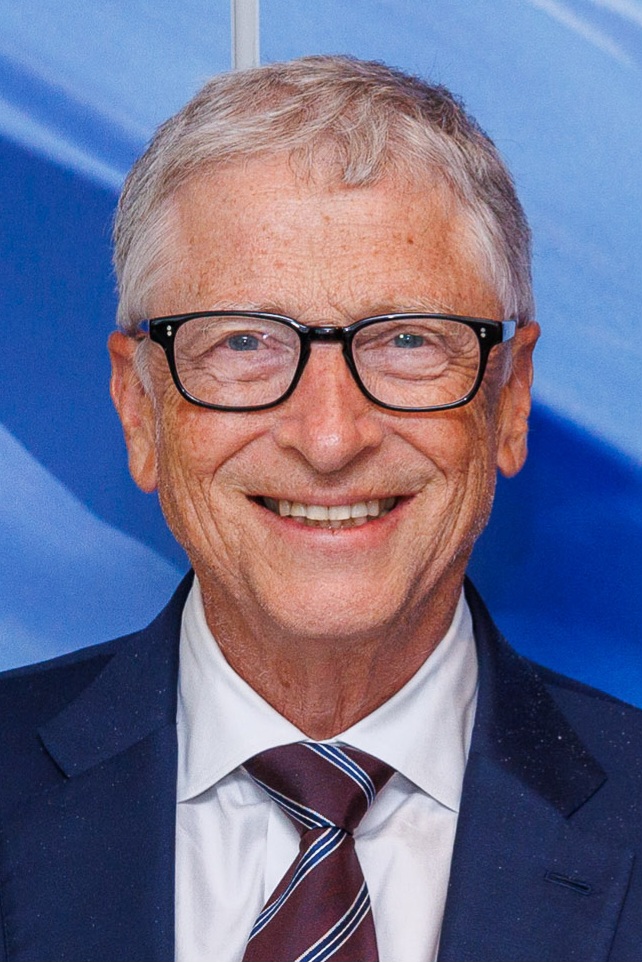

In a forthright message to investors and the global tech community alike, Bill Gates has warned that the current surge in artificial intelligence (AI) investment may include a large number of “dead ends”. Speaking on CNBC’s Squawk Box, Gates described the present moment as akin to the late-1990s dot-com boom — where enthusiasm outpaced sustainable business models.

The Context: Why Gates Raised the Alarm

Gates emphasised that AI is “the biggest technical thing ever in my lifetime”, yet he suggested that the rush of capital and hype around AI mirrors earlier speculative cycles. He pointed out that an overwhelming number of companies have invested heavily in AI without realizing returns — calling attention to what he sees as structural risk beneath the surface of the AI narrative.

According to the Times of India report, Gates pointed to statistics showing approximately 95 % of companies have seen zero return on their AI investments so far — reinforcing his caution that “tons of these investments will be dead ends”.

Key Elements of Gates’ Warning

AI vs Speculative Frenzy

Gates clarified that he did not liken AI to the 17th-century tulip mania, where value inflated entirely on speculation. Rather, he compared it to the dot-com era: valid infrastructure and technological shifts, yes — but many enterprises riding the wave failed due to lack of differentiation or sustainable economics.

Returns Don’t Match the Hype (Yet)

He pointed out that while the underlying potential of AI remains “very very valuable”, current investment patterns often resemble “capital-burning companies” without clear paths to scale, profitability or competitive advantage. Some are spending on data-centres, chips and infrastructure without clear productisation or monetisation strategies.

Risks for Investors and Startups

For investors, Gates’ warning isn’t about avoiding AI altogether — instead it underscores the importance of discerning which AI ventures are likely to succeed. The message: risk of mis-allocating capital is real, and many firms may not survive the shake-out that follows rapid hype cycles.

Implications for the Technology Ecosystem

For Startups & AI Ventures

- Companies must demonstrate differentiation, scalable monetisation and sustainable competitive advantage — not simply hype.

- Over-investment in infrastructure without clear product/market fit may lead to failure despite favourable market conditions.

- VC and investor communities may become more selective, applying lessons learned from previous bubbles.

For Tech Giants & Infrastructure Builders

- Big tech firms investing in AI (data-centres, chips, platforms) may still succeed — but must show how value is captured, not just infrastructure built.

- The ecosystem around AI — including hardware, software stacks, cloud services — may consolidate, favouring those who execute rather than just invest.

For Investors

- Gates’ remarks serve as a cautionary note: exposure to ‘me-too’ AI plays without unique assets or defensible positioning may lead to losses.

- Risk management: portfolio exposure to AI should account for the possibility that a sizeable subset of companies won’t deliver long-term returns.

Why This Matters Now

- AI investment globally is ballooning into the hundreds of billions of dollars. With that scale comes market risk — greater visibility means greater scrutiny.

- The technology shift is real: unlike previous bubbles, Gates acknowledges AI’s profound potential. But risk and reward are both magnified.

- For markets, this signals a turning point: the next phase may feature winners who scale versus many who fade — echoing past tech cycles.

What to Watch Going Forward

- Which companies present tangible business models for AI — not just infrastructure but monetisation and scale.

- Investor sentiment: will Gates’ warning temper excitement, increase caution among VCs or trigger a resizing of valuations?

- Regulation & energy impact: as AI infrastructure grows, so too do energy demands, data privacy and ethical implications — areas Gates has flagged previously.

- Consolidation: will the AI landscape shift toward fewer but stronger players, leaving many small or speculative ventures behind?

Source: