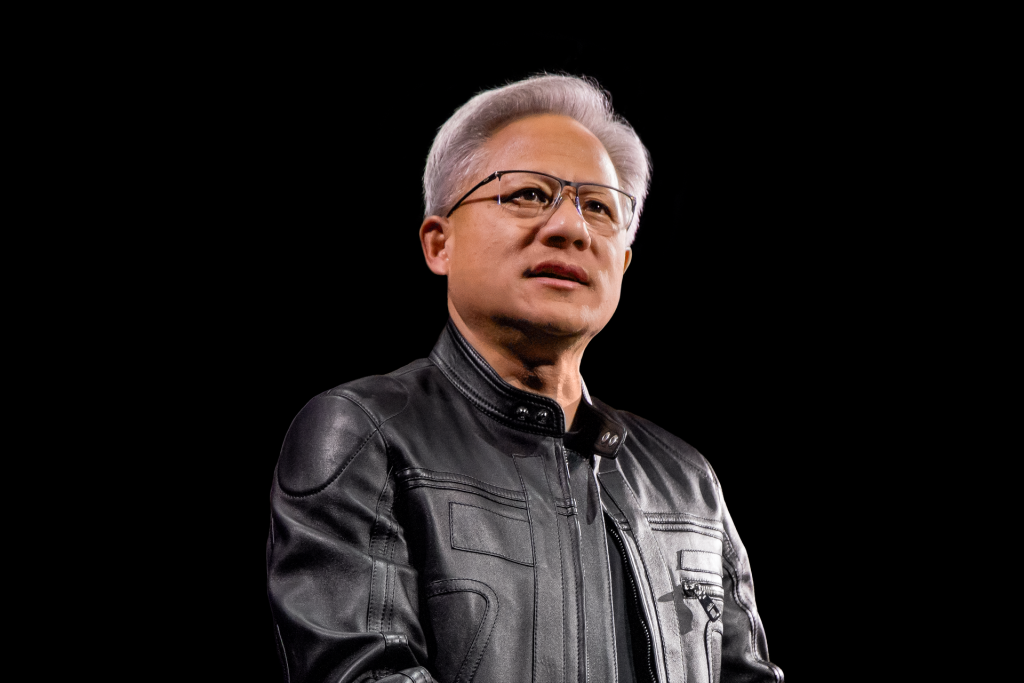

Nvidia CEO Jensen Huang Reassures Investors Amid Soaring Capex by

News THE ECONOMIC TIMES, livelaw.in, LAW, LAWYERS NEAR ME, LAWYERS NEAR BY ME, LIVE LAW, THE TIMES OF INDIA, HINDUSTAN TIMES, the indian express, LIVE LAW .INAs tech giants ramp up capital expenditures for AI infrastructure, Huang describes the surge as strategic fuel rather than reckless spending

San Francisco, United States | Saturday, November 1, 2025

Facing mounting investor concern over the ballooning capital-expenditures (capex) of major technology firms like Google LLC, Amazon Inc., Microsoft Corporation and Meta Platforms Inc., Nvidia’s Chief Executive Jensen Huang offered a counter-narrative to market fears — insisting that the soaring spending is a deliberate, essential step in the unfolding era of artificial intelligence (AI), not a reckless gamble.

Speaking at the Asia-Pacific Economic Cooperation (APEC) CEO Summit, Huang characterised the current phase as a “virtuous cycle” of AI investment — one in which advancements in computing power, data-centre infrastructure and AI models feed demand, which then fuels further investment and innovation. He told investors to view capex from big tech not as cost pressure, but as the fuel for what he called a self-reinforcing AI revolution.

Why Investors Are Worried

Large tech companies have announced unprecedented capex levels this year, with much of the outlay directed at AI infrastructure — data centres, specialised chips, networking hardware, cloud services. The scale of spending has triggered unease among investors: rising costs ahead of clear monetisation paths, concerns over returns, and risk of a mis-timed infrastructure boom.

In particular:

- Microsoft reported massive infrastructure spending, raising concerns over margins and return on investment.

- Meta’s stock dropped sharply, while Google’s revenue growth contrasted with capex expansion — raising questions about which companies will turn massive spending into profit.

- The combined capex among hyperscale tech firms is estimated at hundreds of billions of dollars — a level that has not been tested before.

Jensen Huang’s Message: Investment Is Strategic, Not Excessive

Huang emphasised that Nvidia’s vantage point gives it a clear view of the entire AI infrastructure ecosystem — supply chain, compute chips, data-centres, and large-scale deployments. He argued that large firms are rightly doubling down because AI is not a phase, but the new backbone of computing and services for decades to come.

His key points:

- The current surge in capex reflects long-term bets on AI infrastructure, not short-term speculation.

- Nvidia sees itself as central to that ecosystem — supplying the compute, networking and platforms enabling large tech firms to scale AI.

- The “flywheel” effect: more investment leads to more AI adoption, which leads to more compute demand and higher investment — a cycle many investors misunderstood as reckless until now.

Huang’s remarks sought to shift the narrative from “too much spending” to “strategic scaling at the right moment.”

Implications for Big Tech and Investors

For big tech companies, Huang’s message offers a morale boost: if capex is part of a longer-term plan rather than cost noise, the fear of wasteful spending may be over-blown. But the message doesn’t change the fundamentals investors care about — returns, monetisation, timelines.

Key implications:

- Companies that can link their capex to clear revenue or service growth may emerge as winners.

- Suppliers like Nvidia may benefit directly from large-tech capex — reaffirming why Nvidia has become a central thematic in AI infrastructure.

- Investors should nonetheless watch for capex growth outpacing revenue gains, as that mismatch remains a red-flag.

What to Monitor Going Forward

- How big-tech firms articulate monetisation of their AI infrastructure spends. Without clear pathways to returns, high capex remains risky.

- Nvidia’s guidance and business model: how much of the large-tech spending trickles to Nvidia’s bottom line.

- Market reaction: given concerns (for instance at Meta) about spend vs returns, will investor sentiment shift further if monetisation doesn’t materialise?

- Whether the narrative of “AI infrastructure build-out” remains bullish, or transitions to scrutiny of cost efficiency and returns — a shift Huang is trying to pre-empt.

Source: